What Is PCI DSS? A Complete Guide to Payment Card Security

Updated on January 7, 2026, by Xcitium

What would happen if your customers’ payment data were exposed in a breach? For businesses that process, store, or transmit cardholder data, understanding what is PCI DSS is not optional—it is essential. Data breaches tied to payment systems continue to rise, and regulatory penalties are becoming more severe.

In simple terms, PCI DSS exists to protect payment card data and reduce fraud. This guide explains what PCI DSS is, how it works, who must comply, and how organizations can meet compliance requirements without disrupting operations.

What Is PCI DSS?

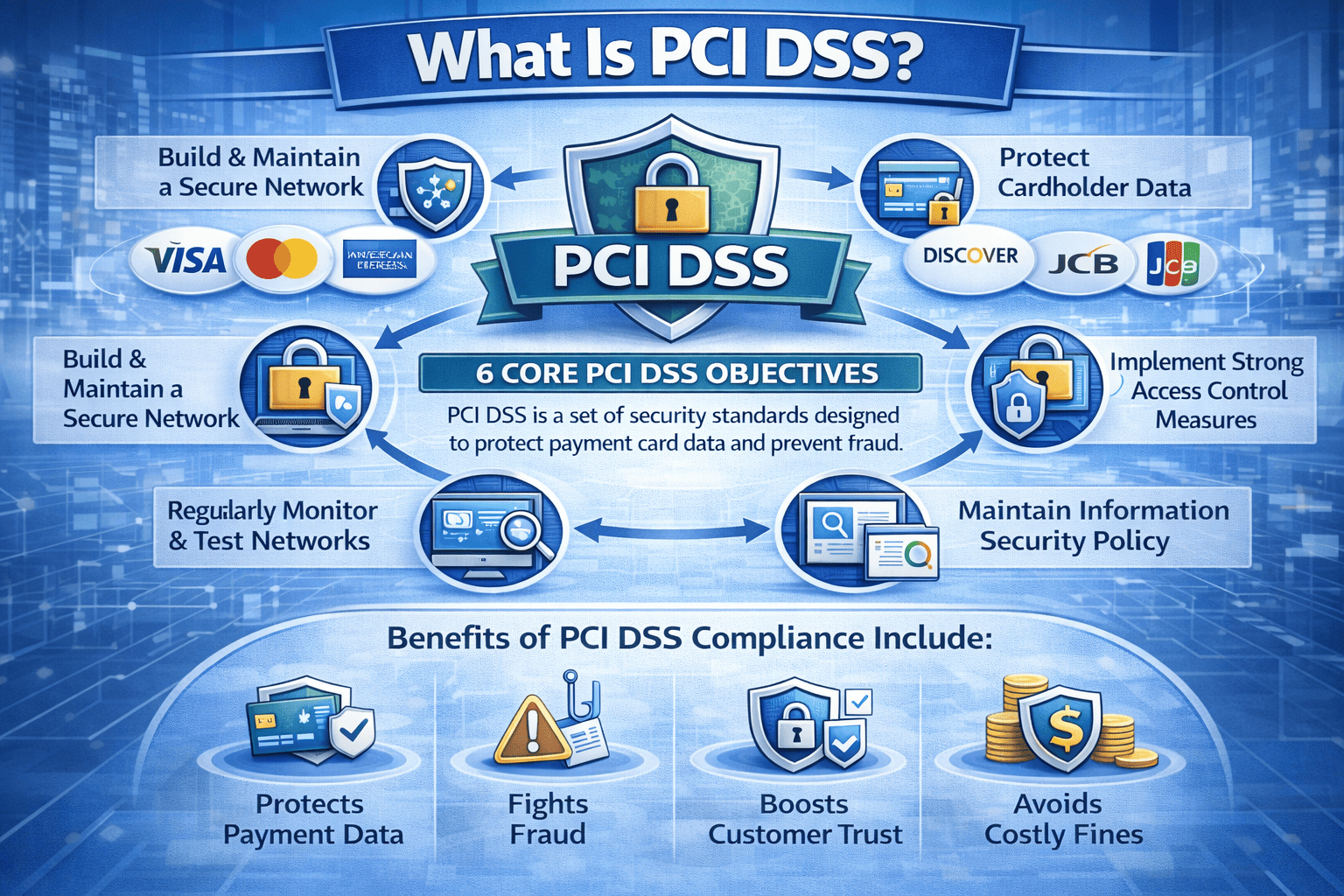

What is PCI DSS? PCI DSS stands for Payment Card Industry Data Security Standard. It is a global security standard designed to ensure that all organizations handling payment card data maintain a secure environment.

PCI DSS was created by major credit card brands, including Visa, Mastercard, American Express, Discover, and JCB. These standards are managed by the PCI Security Standards Council (PCI SSC).

The primary goal of PCI DSS is to protect cardholder data from theft, misuse, and unauthorized access.

Why PCI DSS Matters for Businesses

Understanding what is PCI DSS is critical because non-compliance can result in fines, legal issues, reputational damage, and even the loss of payment processing privileges.

PCI DSS compliance helps organizations:

-

Protect customer payment data

-

Reduce the risk of data breaches

-

Build trust with customers and partners

-

Avoid costly penalties and fines

-

Meet contractual obligations with card brands

For CEOs and founders, PCI DSS is not just an IT concern—it is a business survival requirement.

Who Must Comply With PCI DSS?

Any organization that processes, stores, or transmits payment card data must comply. This includes:

-

Retailers and eCommerce businesses

-

Financial institutions

-

Healthcare providers accepting card payments

-

SaaS and subscription-based companies

-

Hospitality and travel businesses

Regardless of size or industry, if your business touches cardholder data, PCI DSS applies.

How PCI DSS Works

PCI DSS compliance is based on a set of 12 security requirements grouped into six core objectives. These requirements help organizations build and maintain a secure payment environment.

The Six PCI DSS Control Objectives:

-

Build and maintain a secure network

-

Protect cardholder data

-

Maintain a vulnerability management program

-

Implement strong access control measures

-

Regularly monitor and test networks

-

Maintain an information security policy

Understanding what is PCI DSS means understanding how these objectives work together to reduce risk.

The 12 PCI DSS Requirements Explained

1. Install and Maintain Firewalls

Firewalls act as the first line of defense between trusted and untrusted networks.

2. Avoid Default Passwords

Default system passwords are easy targets for attackers and must be changed.

3. Protect Stored Cardholder Data

Sensitive data must be encrypted or securely masked.

4. Encrypt Data in Transit

Cardholder data must be protected when transmitted across public networks.

5. Use Antivirus and Anti-Malware Tools

Active malware protection is required to detect and prevent threats.

6. Secure Systems and Applications

Regular patching and updates reduce known vulnerabilities.

7. Restrict Access to Cardholder Data

Access should be limited based on business need-to-know.

8. Identify and Authenticate Users

Unique user IDs ensure accountability and traceability.

9. Restrict Physical Access

Physical security controls protect systems storing card data.

10. Track and Monitor Access

Logging and monitoring help detect suspicious activity.

11. Regularly Test Security Systems

Vulnerability scans and penetration testing validate defenses.

12. Maintain a Security Policy

Clear security policies guide employees and support compliance.

PCI DSS Compliance Levels

PCI DSS defines compliance levels based on transaction volume. Understanding these levels is part of understanding what is PCI DSS.

Common PCI Compliance Levels:

-

Level 1: Over 6 million transactions annually

-

Level 2: 1–6 million transactions

-

Level 3: 20,000–1 million eCommerce transactions

-

Level 4: Fewer than 20,000 eCommerce transactions

Each level has different validation and reporting requirements.

PCI DSS and Cybersecurity

PCI DSS plays a key role in broader cybersecurity strategies. It enforces baseline security practices that align with modern frameworks like Zero Trust and defense-in-depth.

PCI DSS strengthens cybersecurity by:

-

Reducing attack surfaces

-

Enforcing encryption and access control

-

Promoting continuous monitoring

-

Encouraging regular testing

For IT managers, PCI DSS supports a proactive security posture rather than reactive defense.

Common PCI DSS Compliance Challenges

Many organizations struggle with PCI DSS due to complexity and resource limitations.

Common Challenges Include:

-

Lack of visibility into cardholder data flows

-

Inconsistent security controls

-

Manual compliance processes

-

Limited security expertise

-

Evolving PCI DSS requirements

Understanding what is PCI DSS also means understanding that compliance is an ongoing process, not a one-time task.

PCI DSS for IT Managers

IT managers are responsible for implementing and maintaining PCI DSS controls across infrastructure, applications, and endpoints.

PCI DSS helps IT teams:

-

Standardize security controls

-

Improve incident detection and response

-

Reduce audit preparation time

-

Strengthen endpoint and network security

Automation and centralized security tools significantly reduce PCI compliance workloads.

PCI DSS for CEOs and Founders

From an executive perspective, PCI DSS compliance protects revenue, reputation, and customer trust.

Business leaders benefit from PCI DSS by:

-

Reducing breach-related financial losses

-

Protecting brand credibility

-

Demonstrating security accountability

-

Supporting long-term growth

Understanding what is PCI DSS enables executives to make informed security investments.

Best Practices for Achieving PCI DSS Compliance

Successful PCI DSS compliance requires planning, discipline, and the right technology.

Actionable PCI DSS Tips:

-

Map where cardholder data flows

-

Minimize data storage wherever possible

-

Use encryption for data at rest and in transit

-

Implement continuous monitoring

-

Conduct regular vulnerability scans

-

Train employees on security awareness

These steps simplify audits and strengthen security.

PCI DSS and Cloud Environments

Cloud adoption has changed how organizations manage compliance. PCI DSS still applies, even in cloud-based environments.

Organizations must:

-

Understand shared responsibility models

-

Secure cloud configurations

-

Monitor access and activity

-

Protect cloud-stored cardholder data

Cloud-native security tools help meet PCI DSS requirements without sacrificing flexibility.

The Future of PCI DSS

PCI DSS continues to evolve as threats change. New versions focus more on risk-based security, flexibility, and continuous validation.

Future PCI DSS trends include:

-

Greater emphasis on continuous monitoring

-

Risk-based security controls

-

Automation of compliance tasks

-

Alignment with modern cybersecurity frameworks

Understanding what is PCI DSS today helps organizations prepare for tomorrow’s standards.

Frequently Asked Questions (FAQs)

1. What is PCI DSS in simple terms?

PCI DSS is a security standard that protects payment card data and reduces the risk of fraud and breaches.

2. Is PCI DSS compliance mandatory?

Yes. Any organization handling cardholder data must comply to avoid penalties and loss of payment processing rights.

3. How often is PCI DSS compliance required?

PCI DSS compliance is an ongoing process with annual assessments and continuous security monitoring.

4. What happens if a business is not PCI DSS compliant?

Non-compliance can lead to fines, legal action, reputational damage, and revoked payment privileges.

5. Does PCI DSS guarantee complete security?

No standard guarantees total security, but PCI DSS significantly reduces risk when implemented correctly.

Final Thoughts: PCI DSS Is a Business Imperative

Understanding what is PCI DSS is essential for any organization that accepts card payments. In today’s threat landscape, weak payment security can lead to devastating consequences. PCI DSS provides a proven framework to protect data, reduce risk, and build customer trust.

Compliance doesn’t have to be complex—when supported by the right security strategy and tools.

👉 See how advanced security can simplify PCI DSS compliance:

Request a demo: https://www.xcitium.com/request-demo/