What is Due Diligence? A Complete Guide for Businesses and Professionals

Updated on August 26, 2025, by Xcitium

What is Due Diligence: Have you ever wondered why companies spend weeks or months investigating a potential partnership, acquisition, or vendor before making a decision? That process is called due diligence. Put simply, due diligence is the careful investigation and evaluation of a business, investment, or partner before finalizing a deal.

For IT managers, CEOs, and cybersecurity professionals, due diligence isn’t just financial—it extends to technology risks, compliance, and data protection. In today’s threat landscape, failing to conduct thorough due diligence can result in costly breaches, legal penalties, or failed mergers.

What is Due Diligence? (Definition)

At its core, due diligence means “to take reasonable care” before entering into a business relationship or investment. It’s a structured process of reviewing financial, legal, operational, and security aspects to identify risks.

For example:

- An investor conducts due diligence before buying shares in a company.

- A cybersecurity firm performs due diligence when evaluating a third-party software vendor.

- A business runs due diligence checks before merging with another organization.

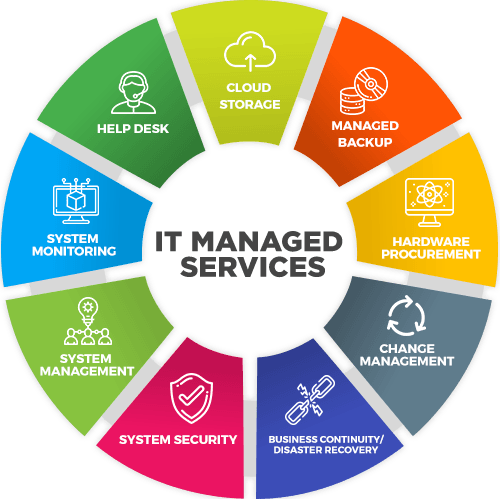

Types of Due Diligence

There isn’t just one kind of due diligence. Depending on the industry, it can take several forms:

1. Financial Due Diligence

- Examines revenue, expenses, debts, and assets.

- Confirms whether financial statements are accurate.

2. Legal Due Diligence

- Reviews contracts, licenses, intellectual property, and ongoing litigation.

- Ensures compliance with regulations.

3. Operational Due Diligence

- Evaluates supply chains, IT infrastructure, and management teams.

- Identifies inefficiencies or hidden risks.

4. Cybersecurity Due Diligence

- Reviews data security policies, compliance (GDPR, HIPAA), and breach history.

- Essential before onboarding vendors or completing mergers.

5. Commercial Due Diligence

- Analyzes market position, competition, and customer base.

- Helps assess long-term growth potential.

Key Steps in the Due Diligence Process

Conducting due diligence usually involves a structured, step-by-step approach:

- Planning and Scoping

Define objectives—what risks or areas need to be investigated? - Data Collection

Gather financial records, compliance documents, and security reports. - Interviews and Questionnaires

Speak with key executives, IT managers, and compliance officers. - Analysis

Compare information against standards, benchmarks, and regulatory requirements. - Risk Assessment

Highlight weaknesses such as outdated cybersecurity practices or high debt. - Final Report & Recommendations

Provide decision-makers with findings and actionable insights.

Why Due Diligence is Critical in Cybersecurity

In the digital age, cybersecurity due diligence is a must-have. Businesses rely on third-party vendors, cloud platforms, and IT services. Without proper vetting, companies risk:

- Data Breaches – caused by vulnerable partners.

- Regulatory Fines – due to non-compliance.

- Reputation Loss – when customer trust is compromised.

Example: In many mergers, the acquiring company evaluates whether the target business has robust endpoint protection, encryption, and compliance with standards like ISO 27001.

Common Challenges in Due Diligence

- Information Overload: Large organizations have massive amounts of data.

- Time Pressure: Deals often have strict timelines.

- Hidden Risks: Not all issues are disclosed upfront.

- Global Regulations: Multinational firms face varying compliance standards.

Best Practices for Effective Due Diligence

- Use checklists to ensure nothing is overlooked.

- Involve multidisciplinary teams (finance, legal, cybersecurity).

- Leverage automated tools for data collection and analysis.

- Conduct continuous due diligence with long-term vendors and partners.

Examples of Due Diligence in Action

- Mergers & Acquisitions (M&A): A company verifies financial stability, cybersecurity resilience, and customer contracts before acquiring another business.

- Vendor Risk Management: IT managers check cloud providers’ data protection policies before signing contracts.

- Investment Decisions: Investors review financial statements, governance practices, and compliance records.

Frequently Asked Questions (FAQ)

1. What does due diligence mean in business?

It’s the process of investigating financial, legal, and operational aspects before finalizing deals.

2. What are the main types of due diligence?

Financial, legal, operational, cybersecurity, and commercial due diligence.

3. How long does due diligence take?

It varies—small vendor checks may take days, while large mergers can take months.

4. Why is cybersecurity due diligence important?

It ensures that partners and vendors comply with data protection laws and have strong security measures.

5. What happens if a company skips due diligence?

It may face unexpected debts, compliance fines, data breaches, or reputational damage.

Conclusion: Due Diligence as a Competitive Advantage

Knowing what due diligence is and applying it effectively protects your business from financial losses, regulatory fines, and cyber risks. Whether you’re an IT manager, investor, or CEO, due diligence ensures smarter decisions and stronger security.

Ready to Secure Your Business with Better Risk Management?

Protect your organization with advanced cybersecurity solutions.

👉 Request a free demo from Xcitium