What Is Fraudulent? A Complete Guide for Professionals & Everyday Users

Updated on August 14, 2025, by Xcitium

Have you ever received a suspicious email asking for your banking details or come across a deal that seemed too good to be true? Chances are, you’ve encountered something fraudulent. Fraud isn’t just a legal term—it’s a real, everyday risk for individuals, businesses, and entire industries.

In simple terms, fraudulent describes something intentionally deceitful, dishonest, or fake, done to secure unlawful or unfair gain. In today’s digital era, where cybercrime costs businesses billions annually, understanding what’s fraudulent is no longer optional—it’s essential.

What Does “Fraudulent” Mean?

The term fraudulent applies to any act or statement designed to mislead, deceive, or cheat another person or entity for personal gain.

Key characteristics of fraudulent behavior include:

- Intentional deception – The person or group knew their action was dishonest.

- Misrepresentation of facts – Providing false or misleading information.

- Personal or financial gain – The ultimate goal is to benefit, usually at the victim’s expense.

- Potential harm – Fraud typically causes financial loss, reputational damage, or both.

Common Examples of Fraudulent Activities

Fraud can occur in many contexts—here are some common scenarios:

- Online Scams – Phishing emails, fake online stores, and investment frauds.

- Financial Fraud – Credit card theft, bank fraud, Ponzi schemes.

- Corporate Fraud – Manipulating financial statements, insider trading.

- Identity Theft – Using someone else’s personal data to commit crimes.

- Insurance Fraud – Faking accidents or damages to claim compensation.

Types of Fraud You Should Know

Fraud isn’t one-size-fits-all—here are key categories:

1. Cyber Fraud

Occurs online and includes phishing, ransomware attacks, and fake websites.

2. Consumer Fraud

Targets individuals through scams like lottery wins, fake tech support calls, or counterfeit goods.

3. Corporate Fraud

Involves deceit within businesses—fake expense claims, embezzlement, or falsifying reports.

4. Financial Fraud

Covers fraudulent investments, stock manipulation, or illegal transfers.

5. Insurance Fraud

False claims for accidents, health issues, or property damage.

How to Identify Something Fraudulent

Fraudsters often follow patterns—here are warning signs:

- Unrealistic offers (“Get rich quick” schemes)

- Urgency & pressure to act immediately

- Requests for sensitive info via email or phone

- Poor grammar & suspicious email addresses

- No verifiable contact information

Tip: If it feels “off” or too good to be true, it usually is.

Fraud in the Context of Cybersecurity

For cybersecurity and IT professionals, fraudulent activity often means detecting:

- Suspicious logins from unusual locations

- Fake security alerts asking users to “verify” credentials

- Malicious links in corporate emails

- Fraudulent payment requests through business email compromise (BEC)

Here, endpoint protection and multi-factor authentication are critical safeguards.

Real-World Impact of Fraud

The impact of fraudulent acts can be devastating:

- For individuals – Financial loss, identity theft, and emotional stress.

- For businesses – Revenue loss, reputational harm, and potential legal action.

- For society – Increased costs for goods and services due to fraud-related losses.

According to recent reports, cyber fraud alone accounted for over $10 billion in losses in the U.S. in 2023.

How to Protect Yourself from Fraudulent Activities

For Individuals:

- Use strong passwords and enable two-factor authentication.

- Avoid clicking suspicious links.

- Monitor bank statements regularly.

- Shop only from verified websites.

For Businesses:

- Conduct regular cybersecurity audits.

- Implement endpoint protection services.

- Train employees on fraud awareness.

- Use encrypted communication for sensitive transactions.

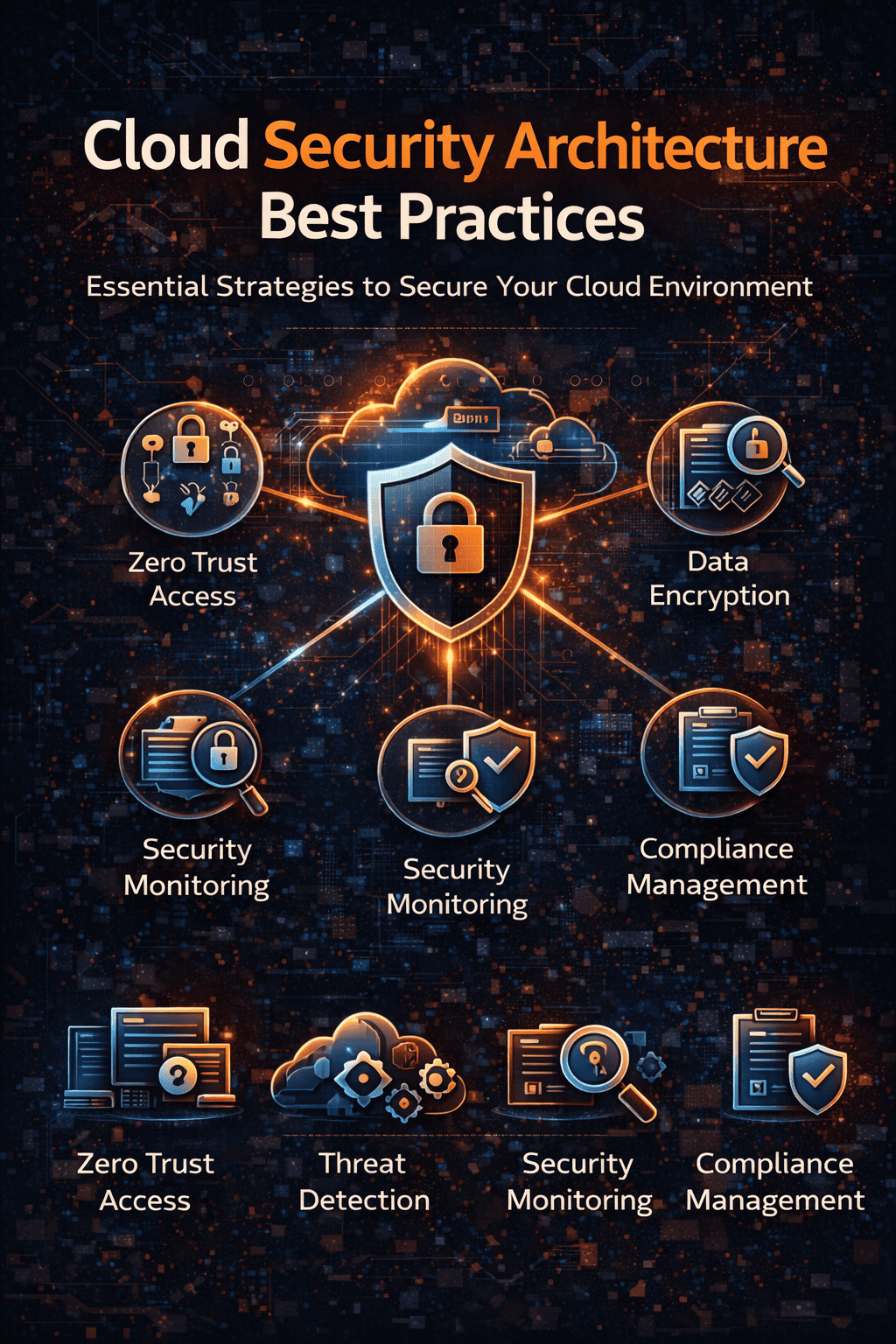

Fraud Prevention Tools & Technologies

Modern fraud prevention involves a mix of technology, policies, and awareness:

- AI-powered fraud detection systems

- Transaction monitoring tools

- Biometric verification

- Data encryption

- Secure payment gateways

Legal Consequences of Fraudulent Behavior

Fraud is a criminal offense in most countries and can result in:

- Fines – Heavy monetary penalties.

- Restitution – Repaying victims.

- Imprisonment – Ranging from months to decades.

- Permanent record – Affecting future employment and reputation.

Frequently Asked Questions (FAQ)

1. What does fraudulent mean in legal terms?

It refers to intentional deception aimed at securing unlawful gain, often punishable by law.

2. Can a company be fraudulent?

Yes, companies can engage in fraudulent practices like falsifying reports or misleading investors.

3. What is the difference between fraud and a scam?

Fraud is a broader legal term, while a scam is a type of fraud often involving tricking individuals.

4. How do I report fraudulent activity?

You can report it to your bank, local law enforcement, or cybersecurity agencies like the FTC.

5. What is fraudulent in cybersecurity?

It refers to deceptive activities conducted online to steal data, money, or disrupt systems.

Final Thoughts

Understanding what is fraudulent is your first step toward protecting yourself, your business, and your assets. Fraud can be subtle, sophisticated, and devastating—but with awareness, the right tools, and proactive measures, you can stay ahead of scammers.

Secure Your Business Against Fraud Today

Don’t wait until fraud strikes. Xcitium’s cybersecurity solutions help detect, prevent, and respond to threats in real time.