What Is Enterprise Risk Management? A Complete Guide

Updated on October 9, 2025, by Xcitium

Did you know that over 60% of businesses face at least one major operational or security disruption annually? In today’s fast-moving, threat-filled environment, managing risks is not just an option—it’s a necessity. That’s where enterprise risk management (ERM) comes in.

Introduction: Why Risk Management Is Critical

If you’ve ever asked yourself what is enterprise risk management and why it matters for businesses, this article will guide you through its definition, benefits, and best practices. From IT managers to CEOs, understanding ERM can help organizations make smarter, safer decisions.

What Is Enterprise Risk Management?

Enterprise Risk Management (ERM) is a structured and comprehensive approach to identifying, assessing, managing, and monitoring risks across an organization. Unlike traditional risk management, which often focuses on isolated risks (like financial or IT risks), ERM takes a holistic view of all potential threats—from cybersecurity attacks to compliance issues to reputational damage.

Key Objectives of ERM

-

Protect organizational assets and data

-

Reduce financial losses from unexpected events

-

Improve decision-making through risk awareness

-

Strengthen compliance and governance

-

Enhance stakeholder trust

In short, ERM ensures that risks are not managed in silos, but instead integrated into the organization’s overall strategy.

Why ERM Matters for Businesses

Businesses today face a complex threat landscape, from cyberattacks to supply chain disruptions. Without ERM, companies often remain reactive instead of proactive.

Benefits of Enterprise Risk Management

-

Comprehensive Risk View – ERM centralizes risk monitoring across departments.

-

Strategic Decision-Making – Leaders make better choices when they understand potential risks.

-

Regulatory Compliance – ERM helps organizations meet regulations like GDPR, HIPAA, and SOX.

-

Resilience Building – Companies can withstand crises with robust ERM frameworks.

-

Improved Reputation – Strong risk management builds trust with investors, customers, and partners.

👉 With ERM, businesses don’t just survive threats—they thrive in uncertainty.

Components of Enterprise Risk Management

To understand what is enterprise risk management, it helps to look at its main building blocks.

1. Risk Identification

-

Spotting internal and external threats

-

Examples: cyberattacks, fraud, compliance failures

2. Risk Assessment

-

Analyzing likelihood and impact of risks

-

Categorizing them (high, medium, low)

3. Risk Response

-

Mitigation strategies (controls, policies, training)

-

Risk acceptance or transfer (e.g., insurance)

4. Monitoring and Reporting

-

Regular audits and dashboards

-

Continuous updates as risks evolve

5. Governance and Oversight

-

Ensuring boards and executives oversee risk strategy

-

Accountability across all departments

The COSO ERM Framework

One of the most widely adopted ERM models is the COSO ERM Framework, which provides guidance for structuring risk management processes.

COSO’s Key Elements:

-

Governance & Culture – Establishing leadership and accountability

-

Strategy & Objective-Setting – Aligning risks with business goals

-

Performance – Assessing and prioritizing risks

-

Review & Revision – Adapting to changes and improvements

-

Information, Communication & Reporting – Keeping stakeholders informed

👉 The COSO model is especially valuable for IT managers and CEOs, as it ties risk directly to business strategy.

Types of Risks Managed by ERM

ERM covers a broad spectrum of risks, including:

-

Operational Risks – System failures, supply chain breakdowns

-

Cybersecurity Risks – Data breaches, ransomware, insider threats

-

Financial Risks – Credit issues, market volatility

-

Compliance Risks – Regulatory violations, legal disputes

-

Strategic Risks – Poor decision-making, failed initiatives

-

Reputational Risks – Negative publicity, customer dissatisfaction

This broad coverage makes ERM an essential risk shield for modern businesses.

ERM in Cybersecurity

In the digital age, cybersecurity is often the biggest risk organizations face. ERM ensures that cyber risks are managed at the enterprise level, not just within IT.

Cybersecurity ERM Best Practices

-

Implement multi-factor authentication (MFA)

-

Conduct regular penetration testing

-

Monitor with SIEM tools for real-time alerts

-

Train employees on phishing and social engineering threats

-

Maintain compliance with data privacy laws

By integrating cybersecurity into ERM, organizations minimize vulnerabilities and protect critical assets.

How ERM Supports Business Growth

Some executives mistakenly see ERM as a cost center. In reality, it’s a growth enabler.

-

Investor Confidence: Businesses with strong ERM are more attractive to investors.

-

Market Expansion: ERM helps identify risks when entering new markets.

-

Innovation Support: Companies can take calculated risks to innovate safely.

👉 With ERM, companies shift from risk avoidance to risk-informed growth.

Implementing Enterprise Risk Management

Rolling out ERM requires planning, leadership, and continuous improvement.

Steps to Implement ERM

-

Secure Executive Buy-In – Gain support from leadership.

-

Form a Risk Committee – Cross-functional representation.

-

Conduct Risk Assessments – Evaluate threats and vulnerabilities.

-

Develop Risk Policies – Formalize governance processes.

-

Deploy Risk Tools – Dashboards, reporting, monitoring software.

-

Train Employees – Build a risk-aware culture.

-

Review & Adapt – Continuously refine the framework.

Challenges in ERM

While ERM provides immense value, organizations face common challenges:

-

Lack of executive support

-

Insufficient data or metrics

-

Over-complex frameworks

-

Resistance to change

-

Rapidly evolving risks (e.g., AI-driven cyberattacks)

Overcoming these barriers requires strong leadership and a culture of accountability.

Future of Enterprise Risk Management

As businesses embrace digital transformation, ERM will continue to evolve. Future ERM will be:

-

AI-Driven – Predictive analytics for risk forecasting

-

Integrated with Cybersecurity – Stronger focus on data protection

-

Real-Time – Continuous monitoring instead of periodic reviews

-

Proactive – Shifting from risk response to risk prevention

Organizations that embrace these trends will be better prepared to manage tomorrow’s uncertainties.

FAQs: What Is Enterprise Risk Management?

1. What is enterprise risk management in simple terms?

ERM is a company-wide approach to identifying, assessing, and managing risks that could affect business objectives.

2. How is ERM different from traditional risk management?

Traditional risk management is siloed, focusing on specific risks. ERM provides a holistic, organization-wide perspective.

3. What industries use ERM the most?

Industries like finance, healthcare, manufacturing, and government rely heavily on ERM for compliance and protection.

4. Who is responsible for ERM?

Boards of directors, executives, risk committees, and all employees play a role.

5. What tools are used in ERM?

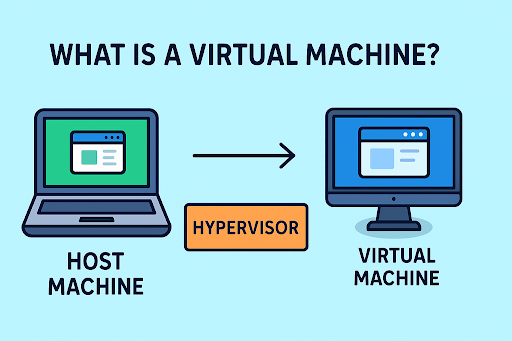

Organizations use dashboards, SIEM tools, compliance management software, and predictive analytics.

Conclusion: Why ERM Is Non-Negotiable

So, what is enterprise risk management? It’s more than just a framework—it’s a strategic safeguard that protects organizations from financial, operational, and cyber threats.

For IT managers, CEOs, and security leaders, ERM is the foundation of resilience, compliance, and growth.

👉 Take the first step in securing your organization against risks. Request a Demo today and strengthen your enterprise risk management strategy.