Introduction: Is Your Financial Data Safe?

Updated on June 3, 2025, by Xcitium

In an age where financial institutions face constant cyber threats, news of the Fidelity data breach has sparked concern among individuals, IT professionals, and executives alike. With trust and data integrity at stake, this event has emphasized the urgent need for airtight cybersecurity frameworks in all sectors.

Whether you’re a cybersecurity expert or a C-suite executive, understanding what happened in the Fidelity Investments data breach and how to respond is critical to defending your own organization’s digital infrastructure.

What We Know About the Fidelity Data Breach

As of the latest reports, Fidelity Investments—a major financial services provider—has been targeted in a sophisticated cyber attack. While official details are still emerging, here’s what’s been publicly confirmed:

Key Details:

- Incident Date: Preliminary signs surfaced in [insert month/year if available]

- Attack Type: Likely phishing-based or exploitation of third-party software vulnerabilities

- Data Impacted: Customer records, potentially including personally identifiable information (PII), account numbers, and investment details

- Breach Detection: Detected through internal monitoring and flagged by threat intelligence partners

Potential Entry Points:

- Compromised credentials

- Cloud misconfiguration

- Vulnerabilities in vendor supply chains

This Fidelity cyber attack exemplifies the increasing sophistication of threat actors targeting financial services.

What Was Leaked? Understanding the Exposure

Though investigations are ongoing, the Fidelity customer data leak may have exposed:

- Full names and addresses

- Social Security numbers

- Account login credentials

- Investment portfolio data

- Internal communications or audit trails

Consequences:

- Identity theft risks

- Financial fraud

- Reputational damage for Fidelity and affected partners

For organizations with ties to Fidelity, through APIs, integrations, or joint services, this leak could present additional downstream security risks.

How Fidelity Responded to the Breach

Immediate Actions:

- Isolated affected systems

- Engaged external forensics teams

- Notified regulatory authorities and law enforcement

- Sent alerts to customers with guidance

Long-Term Measures:

- Reviewing internal security policies

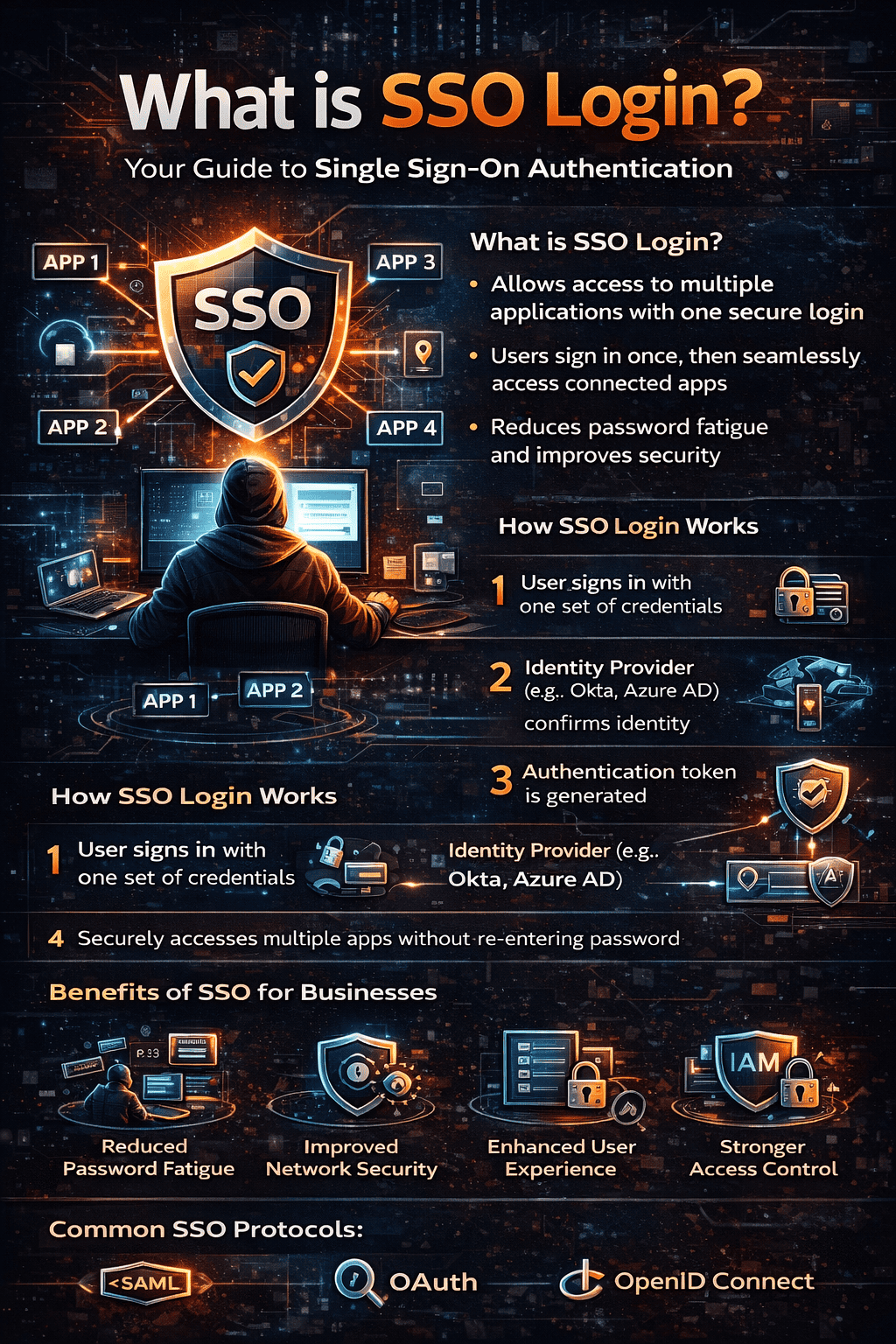

- Strengthening multi-factor authentication

- Implementing endpoint detection and response (EDR)

- Enhancing vendor risk management

Their response mirrors best practices for financial breach recovery, but also highlights the challenges of securing a global financial infrastructure.

Lessons for IT Leaders and Cybersecurity Teams

The Fidelity data breach is a wake-up call for any organization storing or handling sensitive data. Here’s what your team should do now:

1. Reassess Risk Exposure

- Audit your third-party integrations

- Evaluate access controls and user privileges

2. Strengthen Detection & Response

- Deploy SIEM tools and real-time threat monitoring

- Implement behavioral analytics to catch anomalies

3. Enhance Employee Awareness

- Run phishing simulation exercises

- Train staff on recognizing social engineering attacks

4. Prioritize Incident Readiness

- Update your incident response plan

- Run tabletop exercises with C-level stakeholders

Even if your organization wasn’t affected, this is an opportunity to harden your infrastructure.

Industry-Wide Implications of the Breach

Regulatory Impact:

- Heightened scrutiny from the SEC and FINRA

- Mandatory disclosures under GDPR, CCPA, and other frameworks

Market Impact:

- Loss of investor confidence

- Increased insurance premiums for cyber policies

Technological Shifts:

- Renewed interest in zero-trust architecture

- Demand for automated compliance tools

This breach isn’t isolated—it echoes broader vulnerabilities in digital finance ecosystems.

Preventive Measures for Enterprises

- Implement Zero Trust Architecture

- Use AI-powered threat detection

- Regularly patch and test systems

- Enforce strong password policies with MFA

- Centralize access logs for forensic auditing

- Segment networks by access level

Modern cybersecurity must be proactive, not reactive.

Conclusion: Turn Breach Anxiety Into Cyber Resilience

The Fidelity data breach reminds us that even industry giants are vulnerable. For leaders and IT managers, the real question isn’t if you’ll face a cyber incident, but how prepared you’ll be when it happens.

From strengthening your security posture to educating employees and aligning with compliance frameworks, the time to act is now.

👉 Request a custom demo of Xcitium’s breach-prevention tools today

FAQs About the Fidelity Data Breach

1. What caused the Fidelity data breach?

While not officially confirmed, it likely stemmed from credential theft or third-party vulnerabilities.

2. Was customer money stolen?

No unauthorized withdrawals have been confirmed, but investigations are ongoing.

3. How can customers protect themselves?

Change passwords, enable MFA, monitor accounts, and use identity theft protection services.

4. Is Fidelity responsible for damages?

Legal liability is under review, but regulatory fines and lawsuits are possible.

5. What should businesses do in response?

Audit their security controls, reassess vendor risk, and update breach response plans.